Markets Update — Asian shares slide, wheat, corn ease, gold prices drop

Follow-ups -eshrag News:

RIYADH: Over 1,400 Saudi manufacturing companies are now part of the country’s growing network of firms that advance Saudi exports as the Kingdom taps more resources to develop and expand local industry, said Faisal Al-Maghlooth, director general of Made in Saudi Program at Saudi Made.

“We are proud to have more than 1,400 companies that represent the national industry identity, enhance the quality of the local product and make it a first choice for the consumer in all markets,” Al-Maghlooth told Arab News on the occasion of the first anniversary of the Made in Saudi Program.

He proudly pointed to some important developments and factors that have helped shape the Saudi industry. “Within one year of starting Made in Saudi Arabia, there have been many achievements that we are proud of.

‘Made in Saudi’ (program) seeks to market national goods and services to become the preferred option locally and globally.

Faisal Al-Maghlooth

There are more than 30 strategic partners, and more partners are being added,” Al-Maghlooth informed.

Up until now, more than 6,500 products have been registered by Saudi companies and 147 firms have launched their products in the market under the slogan “Made in Saudi Arabia” in various fields of food, chemicals, iron, pharmaceuticals, paints and others.

Asked about the contributions made by “Made in Saudi Arabia” at the local economic level, Al-Maghlooth said there were plenty. “Increasing domestic consumption of national goods and services, raising the share of national products, especially those with higher local content, in the Saudi market as well as in our exports, increasing Saudi non-oil exports to priority export markets and enhancing the attractiveness of the Saudi industrial sector for local and foreign investment,” he noted.

‘Made in Saudi Arabia’ advantage

Al-Maghlooth highlighted some of the advantages in joining the program. “Many advantages have been achieved by the companies that joined, the most important of which is the use of the Made in Saudi Arabia logo on the company’s registered products, which contributes to strengthening its institutional and marketing presence with member companies and products registered under the same logo,” he pointed out.

Moreover, these firms benefited from all the posts and marketing campaigns launched by the Saudi Export Development Authority under the slogan “Made in Saudi Arabia” through social networking sites, facilitating members’ communication with all government agencies, exchanging experiences in specialized fields, training in developing local content, entering global and export markets, using the logo on products that meet recognized national content and quality standards.

Al-Maghlooth emphasized the importance of the Saudi private sector in the program. “It is important to clarify that ‘Made in Saudi’ (program) seeks, as I mentioned earlier, to market national goods and services to become the preferred option locally and globally, and this can only be achieved in close and vital cooperation with the private sector, as well as the public sector,” he said.

One of the goals that the program is working on is to develop the contribution of the private sector to the national economy, and even to unleash the capabilities of the promising non-oil sectors, which are always focused on by Crown Prince Mohammed bin Salman when talking about the Saudi economy, according to Al-Maghlooth.

As for the eligibility to register products in the program, it revolves around fulfilling the requirements for adding value, meaning that the percentage of local materials included in the final product is not less than 40 percent.

This program will also enable both Saudi men and women to join the workforce of the rapidly growing industry and will further enhance medium, small and micro-enterprises.

Diversifying the economy

This development comes at a time when Saudi Arabia has made steady and giant steps to diversify the economy and reduce dependence on oil as the main source of revenue.

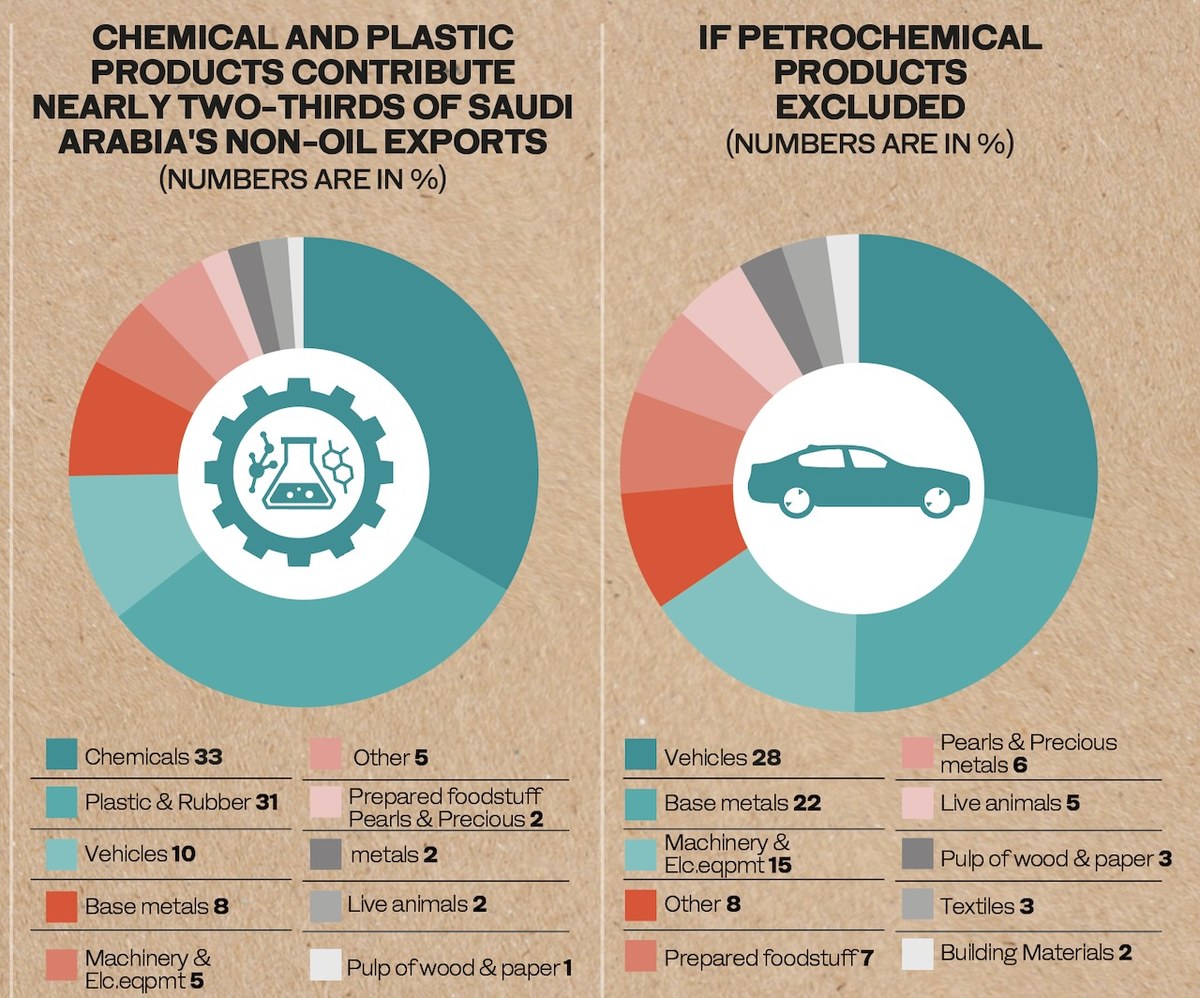

All indicators and available statistics show that the Kingdom is on the right path to increase the share of non-oil exports in general.

Although oil exports still have the lion’s share of total exports (more than 70 percent), the private sector, with the support of the government, has succeeded in opening new markets around the world for non-oil products.

The drive to boost non-oil exports was also seen as an integral part of the ambitious Vision 2030 agenda that is supposed to shape the Saudi economy.

According to the Saudi General Authority for Statistics, GASTAT, non-oil Saudi exports to the rest of the world in 2021 stood at $61.7 billion compared to $45.1 billion in 2020, an increase of 89.52 percent.

Total Saudi non-oil exports in 2019 stood at $50 billion, based on GASTAT data.

In the fourth quarter of 2021, non-oil exports surged to $12.6 billion compared to $12.2 billion in the same quarter of 2020, an increase of 14.13 percent.

China remained the largest recipient of Saudi non-oil products as evident by official statistics.

In the fourth quarter of 2021, Saudi non-oil exports to China amounted to SR55.3 billion ($14.7 billion), or 17.3 percent of total exports.

India and Japan followed next with SR34 billion and SR33.3 billion respectively.

South Korea, the UAE, the US, Egypt, Singapore, Taiwan and Bahrain were the other countries that ranked in the top 10 destinations. Exports of Saudi Arabia to those 10 countries amounted to SR225.4 billion, accounting for 70.4 percent of total exports.

The data compiled by Arab News also showed that Saudi Arabia’s non-oil exports helped reduce some of the negative impact from the volatility in the Kingdom’s oil exports revenues.

“The volatility in non-oil exports revenues on a yearly basis was relatively milder than that for oil exports,” according to recent GASTAT data.

The diversification of the Saudi economy including increasing exports is at the heart of Saudi Vision 2030.

The Vision 2030 aims to increase non-oil exports from 16 percent to 50 percent of non-oil gross domestic product by 2030.

The Kingdom seemed very determined to open new markets for its non-oil products irrespective of the number of years to realize this objective.

The purpose of these studies are to help policymakers in the Kingdom to develop a modern and effective approach to streamline the Saudi economy in a bid to allow the non-oil sector to increase exports to other countries in the world.

Based on the promising data over the past few years, Saudi Arabia will most likely increase non-oil exports and even focus on other products besides chemicals and plastic.

Noting that the news was copied from another site and all rights reserved to the original source.

xnxx,

xvideos,

porn,

porn,

xnxx,

Phim sex,

mp3 download,

sex 4K,

Straka Pga,

gay teen porn,

Hentai haven,

free Hentai,

xnxx,

xvideos,

porn,

porn,

xnxx,

Phim sex,

mp3 download,

sex 4K,

Straka Pga,

gay teen porn,

Hentai haven,

free Hentai,