MENA’s 10 most funded fintech startups

Follow-ups -eshrag News:

RIYADH: The entrepreneurial ecosystem has been on the rise in the Middle East and North Africa region for a while, with technology-based sectors starting to dominate the business landscape.

Financial technology, popularly known as fintech, has been a promising sector for business people and investors alike, with startups entering and exiting the industry like never before.

The numbers speak for themselves. Startup funding increased 540 percent in the first quarter of 2022 compared to the same time last year, reported Dubai-based MAGNiTT, a startup research platform.

To get a sense of the action in the fintech domain, Arab News has compiled a list of the 10 most funded fintech startups in the MENA region.

Foodics

Founders Ahmad Al-Zaini, Musab Al-Othmani

Funding $198 million

Rounds: 5

Investors 17 investors including STV, Sanabil and Prosus

Headquarters Saudi Arabia

Foodics offers a point-of-sale management system for restaurants that lets business owners keep track of all their operations, from the kitchen to employees and sales.

The company offers many facilities that support restaurant operations, including micro-lending and payments catering to food and beverage establishments.

In its latest funding round, Foodics secured $170 million in a series C round, allowing it to grow its fintech arm and micro-lending operations.

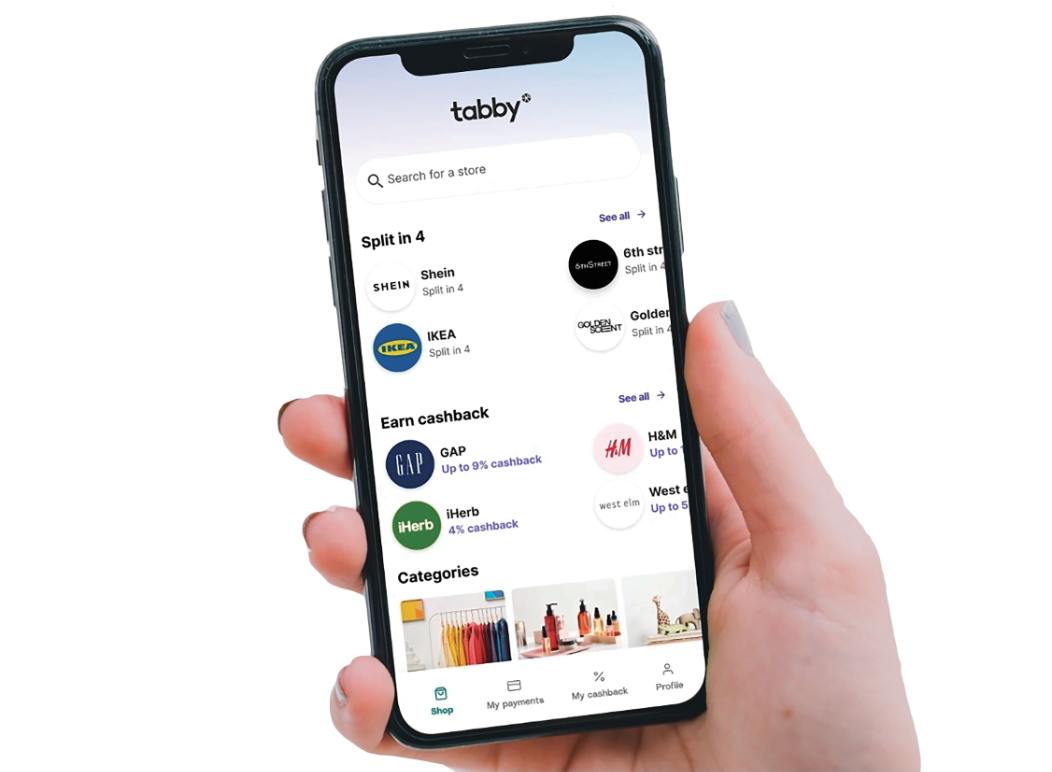

Tabby

Founders Hosam Arab, Daniil Barkalov

Funding $186 million

Rounds 7

Investors 19 investors including STV, Global Founders Capital and Raed Ventures

Headquarters UAE

One of the leading buy-now-pay-later platforms in the region, Tabby aims to provide financial freedom to shoppers by offering solutions without interest or debt fees.

Focusing on the retail sector, the company wants to improve the shopping experience of its loyal customers by offering a flexible checkout experience.

Tabby raised $54 million in its last series B round, and it aims to use it to expand its product offering.

Tamara

Founder Abdulmohsen Al-babtain, Abdulmajeed Al-sukhan, Turki Bin Zarah

Funding $116 million

Rounds 4

Investors 9 investors including Impact46, CheckOut.com and Nama Ventures

Headquarters Saudi Arabia

Another pioneer in the buy-now-pay-later market, Tamara is a Saudi-based fintech that offers its solutions to merchants and buyers alike.

The company aims to create a seamless experience for shoppers by providing a zero-interest fee for its services.

In 2021, Tamara raised $110 million in a series A round, making it a record-breaking round last year.

Paymob

Founder Islam Shawky, Alain El-Hajj, Mostafa Menessy

Funding $68.5 million

Rounds 4

Investors 10 including PayPal Ventures, Nclude and A15

Headquarters Egypt

Paymob, one of the players that changed the game in the Egyptian market, is a complete fintech solution for emerging markets and small and medium enterprises.

The company offers a complete digital payment solution for businesses to accept online and in-store payments.

Founded in 2015, Paymob raised $50 million in a series B funding round in May 2022, which was used in product development and market expansion.

PostPay

Founder Tariq Sheikh

Funding $63.5 million, according to Forbes

Rounds Undisclosed

Investors Touch Ventures and AfterPay

Headquarters UAE

Founded in 2019, Postpay is a flexible payment firm that offers shoppers to pay in three monthly interest-free installments at its partner stores.

The company works with leading global brands such as H&M, Footlocker, Dermalogica and domestic merchants such as The Entertainer and Squat Wolf.

Last June, the company secured $10 million in equity investment; the funds will be used to fuel its expansion plans across the MENA region.

HyperPay

Founder Muhannad Ebwini

Funding $50.5 million

Rounds 4

Investors 8 including Mastercard and AB Ventures

Headquarters Saudi Arabia

HyperPay offers a payment gateway for online businesses to accept and manage

payments online with flexibility and security.

Founded in 2014, the company has an extensive network of partners with banks across the Middle East and North Africa to better facilitate online payments in local currencies.

In its last funding round, HyperPay secured $36.7 million in June 2022 to enable the company to grow its team and introduce new payment solutions.

Khazna

Founder Omar Saleh, Ahmed Wagueeh, Fatma Shenawy

Funding $47 million

Rounds 7

Investors 12 including Quona Capital, Khawazimi Ventures and Nclude

Headquarters Egypt

Another Egyptian fintech startup that tops the list, Khazna, is a financial super app that offers a wide range of solutions for underserved individuals.

The company aims to provide

the 20 million underserved Egyptians with banking and financial options through their smartphones.

Founded in 2019, the company raised $38 million in March 2022, allowing it to replace cash-driven alternatives across Egypt.

BitOasis

Founder Daniel Robenek, Ola Doudin

Funding $30 million

Rounds 6

Investors 15 including Wamda and Jump Capital

Headquarters UAE

A new kind of fintech added to the list, BitOasis is a cryptocurrency trading platform that offers a digital asset wallet.

Founded in 2015, the company allows users to buy, sell, trade and exchange crypto assets in the UAE.

Raising $30 million in its last funding round, BitOasis got approvals from the Abu Dhabi General Market and partnered with police entities to combat crypto fraud.

Telr

Founder Khalil Alami

Funding $28.9 million

Round 4

Investors 4 including Cashfree Payments and iMena Group

Headquarters UAE

An award-winning payment gateway provider, Telr has offices in Singapore, the UAE, India, and Saudi Arabia.

The company offers businesses a set of application programming interfaces and tools to enable them to accept and manage online payments.

Telr raised $15 million in a funding round in 2021 by India-based Cashfree payments to better facilitate cross-border payments.

Paytabs

Founder Abdulaziz Al Jouf

Funding $25.3 million

Rounds 2

Investors Saudi Aramco

Headquarters Saudi Arabia

Another award-winning startup, Paytabs, is a B2B online payments solutions provider that aims to give merchants digital payment features on their websites.

The company offers application programming interfaces to facilitate transactions in multiple currencies and other markets.

Founded in 2014, Paytabs is a Saudi Aramco-backed company that currently operates in the UAE, Saudi Arabia and Egypt.

Noting that the news was copied from another site and all rights reserved to the original source.

xnxx,

xvideos,

porn,

porn,

xnxx,

Phim sex,

mp3 download,

sex 4K,

Straka Pga,

gay teen porn,

Hentai haven,

free Hentai,

xnxx,

xvideos,

porn,

porn,

xnxx,

Phim sex,

mp3 download,

sex 4K,

Straka Pga,

gay teen porn,

Hentai haven,

free Hentai,