Cloud computing helps power strong Microsoft quarter

Follow-ups -eshrag News:

Growing GCC ownership of electric vehicles bodes well for a zero-emissions future

DUBAI: Among the many industries facing pressure to make fundamental changes to their production processes is the automobile sector, a major emitter of greenhouse gases blamed for global warming.

Once in use, a typical passenger vehicle emits about 4.6 metric tons of carbon dioxide per year, according to the US Environmental Protection Agency.

This assumes the average gasoline-driven vehicle on the road today has a fuel economy of about 22 miles (35.5 kilometers) per gallon (4.5 liters) and drives 11,500 miles (18,507 kilometers) per year. Every gallon (4.5 liters) of gasoline burned adds some 8,887 grams of carbon dioxide to the atmosphere.

Such numbers raise the question of whether it is even possible for the titans of the automobile industry to significantly reduce their carbon footprints so that they can meet their environmental, social and governance criteria.

Fortunately, a surge in the popularity of EVs in the relatively affluent GCC countries is bringing the region closer to trends that characterize Western markets.

Growing by leaps and bounds over the past decade, the global EV market was valued at $370.86 billion in 2021, and it is expected to reach over $1.2 trillion by 2027.

Additionally, global sales of EVs have more than doubled to $6.6 million in 2021, according to the International Energy Agency, with green mobility making up 9 percent market share of the global car industry. This is more than double the share it commanded in 2020 and triple of what it had in 2019.

In the Middle East, interest in eco-friendly alternatives to the internal combustion engine vehicle is slowly growing as automobile manufacturers race to bring more EV models to the market every year.

Saudi Arabia aims for at least 30 percent of its cars to be electric powered by 2030, following its pledge to reach net zero carbon emissions by 2060. Last year, EV manufacturer Lucid announced a long-term plan to build the first international manufacturing plant in Saudi Arabia, targeting 150,000 vehicles per year at the King Abdullah Economic City.

Meanwhile, the UAE is pushing for 42,000 EVs to be on its streets within the next decade. To meet the rise in demand for green mobility, the UAE opened its first electric vehicle manufacturing facility in Dubai Industrial City last month, built at a total cost of $408 million. The facility is expected to produce 55,000 cars per year.

There is strong competition for a share of the GCC region’s EV market, with brands such as Tesla leading the charge and others including BMW, Audi and Mercedes-Benz in close pursuit.

Noor Hajir, head of transport planning and mobility at WSP Middle East, says there are positive signals in the Gulf marketplace, with many developers, particularly those in Saudi Arabia, embracing greener alternatives and future mobility solutions such as EVs to help them achieve their future net-zero targets.

“We’re seeing a trend of private developers leveraging EV charging stations as a branding and customer incentivization tool within assets such as major malls and business districts,” she said.

Still, Hajir believes the region has a long way to go before the infrastructure required to make widespread private and public EV adoption a reality is in place.

“The Middle East may be behind the curve compared with more developed economies in providing roadside infrastructure to facilitate and incentivize widespread private EV ownership, which relies heavily on public sector endorsement,” she told Arab News.

Dr. Hamid Haqparwar, managing director of BMW Group Middle East, said infrastructure development for EVs in the region varies from country to country, resulting in different rates of adoption across markets.

But like many other experts in the field, he believes the region’s overall direction is clear. Greener modes of transport are a key part of the sustainability visions set by governments, and mass adoption of electrified vehicles per market is “a matter of when, not if.”

Haqparwar says during the current “transition” phase the region is witnessing a wider range of EVs enter its markets, confirming that manufacturers will continue to expand their EV portfolio.

“This growth of supply, along with expansion of the required infrastructure, will gradually increase the demand in the Middle East,” he told Arab News. “I would expect EV sales to see more growth in the next five years.”

As desirable as the viability of EVs in the Middle East market may be, it is not without its challenges.

INNUMBERS

* 33% Environmental damage caused by an automobile before it is sold and driven.

* 3% Hybrid and EVs’ share of total new vehicle sales in KSA.

* 8% Saudis who think EVs will be increasingly common in the future.

One of the main gaps exists in the regulatory framework, both at the base economy and local authority levels, according to Hajir of WSP Middle East.

For example, in Saudi Arabia, where EV rollout is still in its initial stages, updates to these regulatory frameworks are required to streamline certification processes and encourage uptake, she told Arab News.

Additionally, she cited global-supply chain issues and the consequent lag time in manufacturing as a major challenge currently facing vehicle manufacturers.

The delays are likely to have a knock-on effect on some of the immediate EV projects being implemented in the Middle East.

“Average procurement and delivery of EVs can take anywhere between six and 18 months,” said Hajir, pointing out that adequate implementation planning and early engagement of both operators and manufacturers need to be considered by mobility service providers.

Then there is the Middle East’s hot, arid climate, which might adversely affect the longevity of battery life in EVs. Hajir says more Middle East-centric data concerning the full impact of heat on EV batteries is urgently needed.

For this as well as many other reasons, internal combustion engines are certainly still going to be on our roads, says Haqparwar of BMW Group Middle East. In his opinion, driving will continue to be a huge part of people’s lives in the GCC.

“Where other parts of the globe will see less cars on the road, this region is more likely to see new environmentally friendly models on our roads as individual mobility steps into a new era,” he said.

Haqparwar pointed out that while industry wide growth in EV sales is in line with evolving sustainability driven values of the region’s young demographic, emotional sentiments still play a major role in their purchasing decisions.

At the same time, the region’s younger generation’s growing environmental consciousness is reflected in online conversations surrounding EVs in the GCC.

Rami Deeb, marketing manager CEEMEA at Talkwalker, the industry leading consumer intelligence platform, believes that real-time data will play a critical role in the development of the regional EV industry.

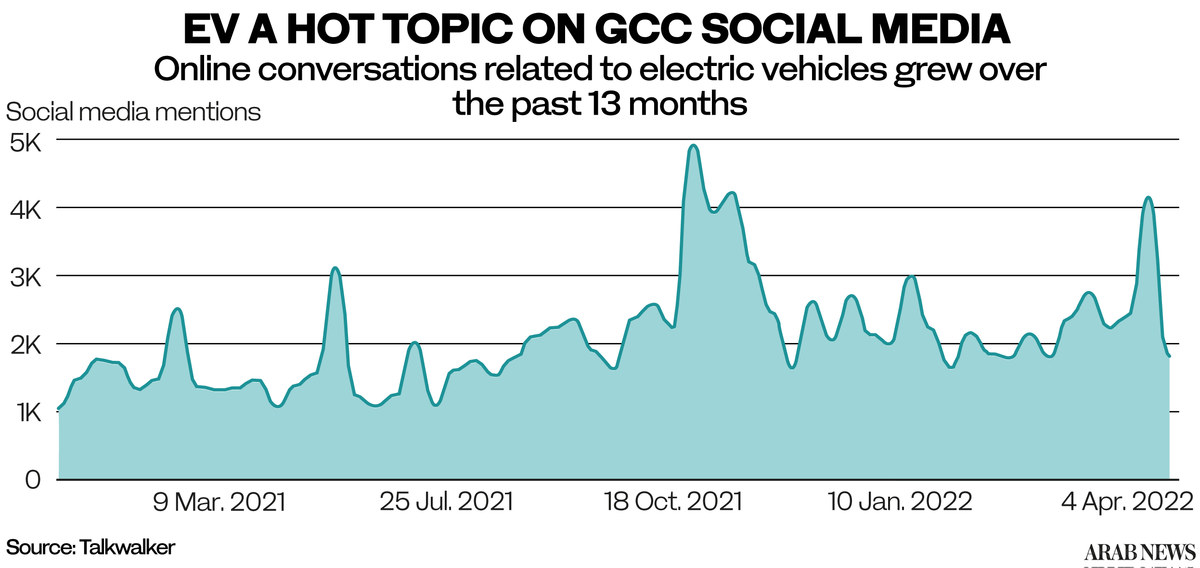

The company, which tracks conversations on blogs, social media, videos, audio, forums, and reviews sites in six countries — KSA, UAE, Bahrain, Qatar, Kuwait and Oman — reports a positive trend around EVs in the GCC region over the last 13 months.

During this time, there were more than 133,000 online conversations around EVs in the GCC region, 21 percent of which have positive sentiment and revolve around government pledges to become net-zero in the near future.

Those who fall within the 25-34 age group discussed the latest technological innovations and mainly engaged with video customer reviews of EVs.

The 18-24 age group mostly shared their enthusiasm about the future and how technology companies like Apple and Sony are exploring the EV space with concept cars and 3D renders, said Deeb.

The same age group also discussed the harmful environmental impact of battery manufacturing and lithium mining.

In a study conducted in the Kingdom by the consulting firm Kearney late last year, 15 percent of the Saudi nationals polled said they intended to own an EV in the next three years, while 33 percent said the availability of more charging stations would increase their interest in buying one.

Another 23 percent said that the provision of more information and government fee exemptions could make ownership of an EV more appealing.

“GCC consumers are reacting positively to the potential of EVs in reducing carbon emissions, as well as the level of innovation they bring to the table,” said Deeb.

Simultaneously, “major car manufacturers around the world are developing a clear road map to fit their factories into an EV future and announcing their plans to only build EV cars,” he said.

In a handful of countries, several incentives are being implemented to increase consumer demand and interest, like dedicated free EV parking spaces, free toll tags, and free charging through the public EV charging network.

Given the abundance of market signals, Deeb believes the real “threat” to the industry would be any resistance to change or disregard for consumer preferences.

Noting that the news was copied from another site and all rights reserved to the original source.

xnxx,

xvideos,

porn,

porn,

xnxx,

Phim sex,

mp3 download,

sex 4K,

Straka Pga,

gay teen porn,

Hentai haven,

free Hentai,

xnxx,

xvideos,

porn,

porn,

xnxx,

Phim sex,

mp3 download,

sex 4K,

Straka Pga,

gay teen porn,

Hentai haven,

free Hentai,